Introduction

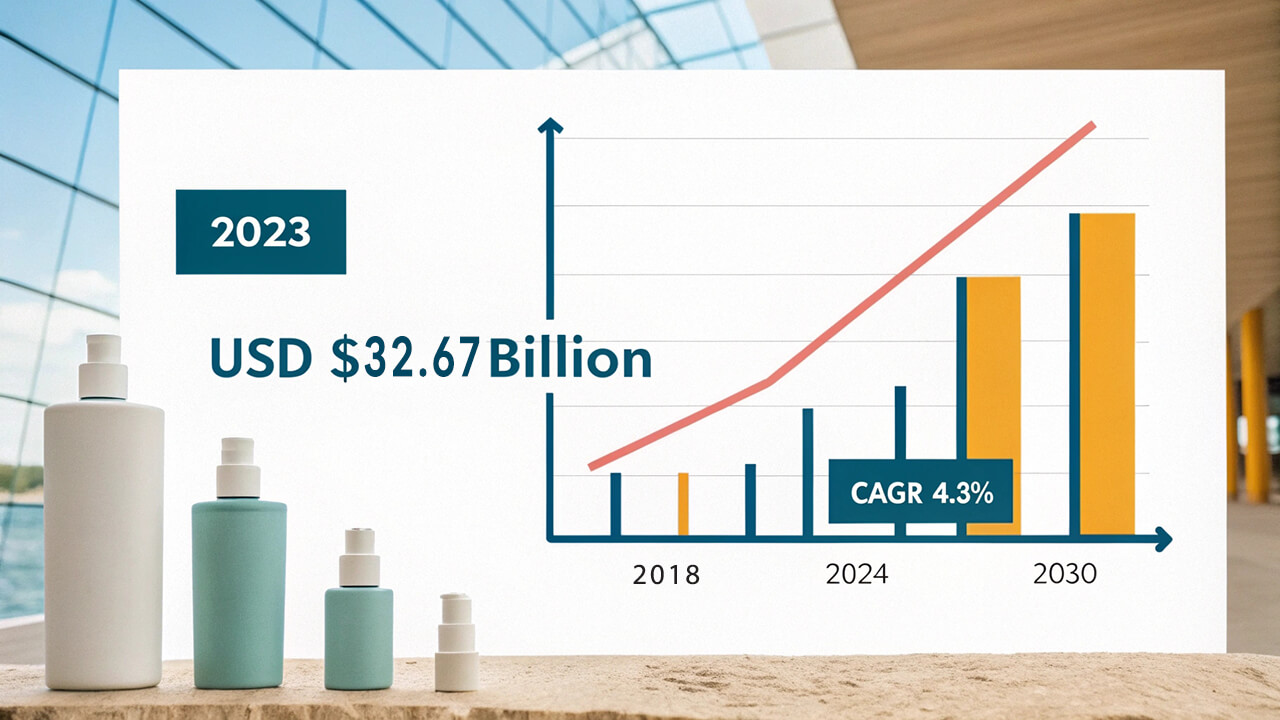

The world of beauty investment six years ago has completely changed: the myth of traffic has ended, and biotechnology and AI have become new favorites; capital has shifted from frenzy to rationality, with 30 billion yuan flowing to 43 brands, and technological strength and long-term value have become core evaluation indicators. The global beauty industry is undergoing a capital revolution from opportunity hunting to deterministic cultivation.

If an investor traveled from six years ago to today, he would probably be surprised by the current world of beauty investment – traffic is no longer the investment theme, and peers are talking about biotechnology, AI, and brand value; brand professionals with FMCG backgrounds are no longer sought after, while doctors with science and engineering backgrounds are favored by the entire industry; super deals are becoming fewer, and capital tends to lock in market share at a small cost.

This trend of rational investment emerged in the first half of 2023 (when synthetic biology and medical aesthetics investments exploded) and became increasingly clear as the business of beauty groups continued to slow down.

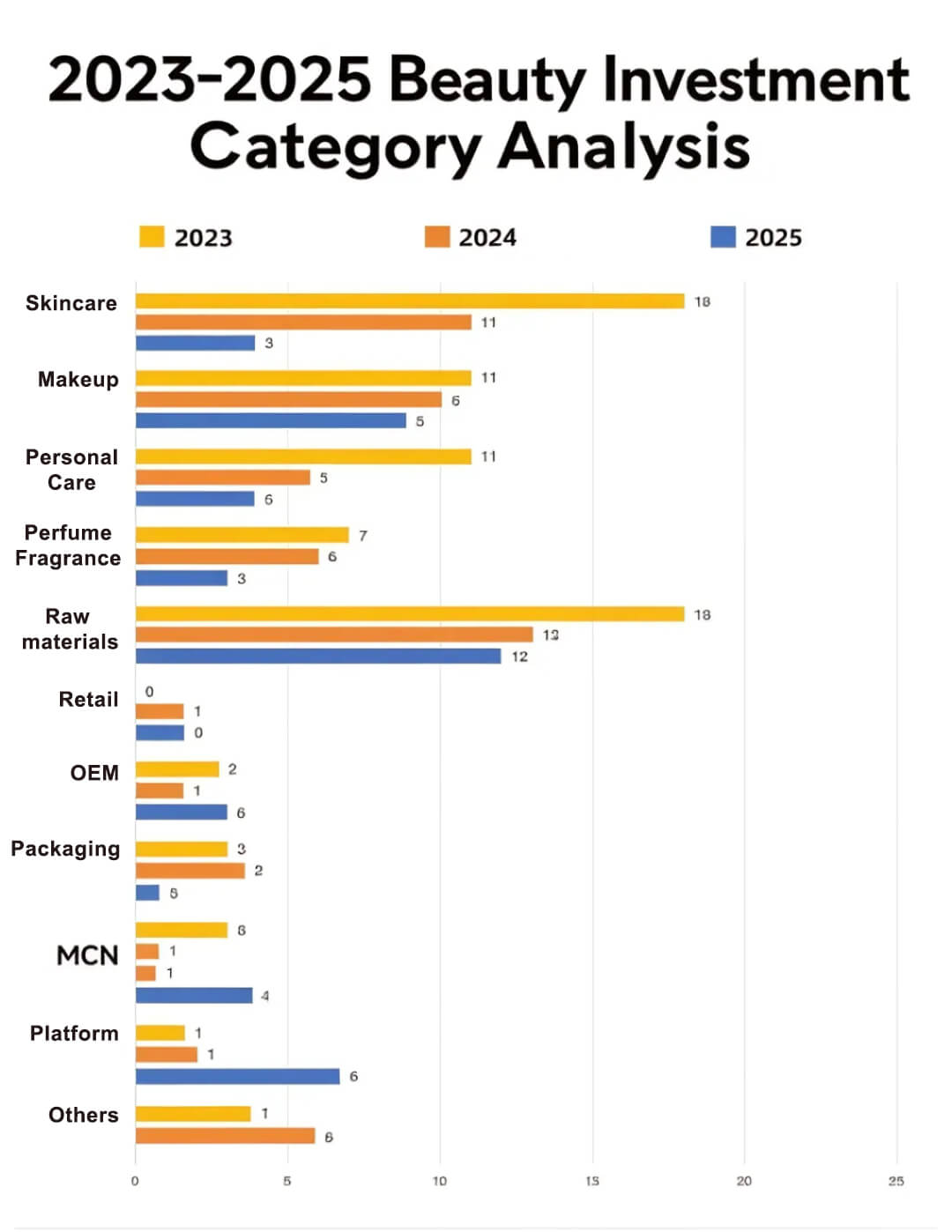

According to incomplete statistics from Cosmetics Observation, from January this year to now, there have been 79 investment and financing events in the global beauty industry, covering brands and upstream and downstream of the beauty industry. The disclosed 46 investment and financing events amount to nearly 40 billion yuan. Among them, skincare, biotechnology, and personal care are the most favored by capital, with 18, 18, and 11 investment and financing events respectively, occupying a dominant position.

From the perspective of industrial cycle evolution, a map of capital migration is emerging:

In 2018, capital chased the marketing miracle of emerging makeup – in 2020, it turned to betting on clinical verification of efficacious skincare – today, on investors’ due diligence lists, whether technological strength/brand tone can forge long-term support has become a more important evaluation indicator.

This fundamental change in capital narrative will reshape the valuation logic of the entire industry.

| Inventory of Beauty Investments from January to July 2025 | |||||

| Time | Investor/Buyer | Action | Target | Region | Amount |

| January | Unilever | Acquisition | Minimalist | Indian local skincare | 30 billion rupees |

| January | Hillhouse | Investment | Ras Luxury Skincare | Indian high-end skincare | 5 million USD |

| January | Luna | Acquisition | Rembrand | American whitening | 23 million USD |

| January | Hillhouse | Investment | Foxitale | South Korea | 30 million USD |

| January | L Catterton under LVMH | Investment | California Naturals | American skincare | 4 million USD |

| January | KL & Partners | Acquisition | Mentholatum Manyo | South Korean skincare | 190 billion won |

| January | National Investment Fund + Mayhoola | Investment | Etro | Italian luxury goods | Undisclosed |

| January | CVC Capital | Investment | Serin Company | South Korean beauty | 26 million USD |

| January | Peterson Partners | Investment | Gloss Ventures | American beauty | Undisclosed |

| January | Rongyu Venture Capital | Investment | First Cover™ | South Korean skincare | Undisclosed |

| January | Investment | Sae rom | South Korean skincare | 50 million won | |

| January | Yibang Investment | Investment | Naderma | South Korea | 50 million USD |

| January | Investment | Jion Beauty | South Korea | 3 million USD | |

| January | Investment | Milu | South Korea | 4.5 million USD | |

| January | Investment | Aloha | South Korea | Undisclosed | |

| January | Beauty under Designworks Collective | Acquisition | Archipelago Botanicals | USA | Undisclosed |

| January | L’Oreal | Acquisition | Laneige Style | South Korea | Undisclosed |

| January | Jacquemus | Investment | Amouage | French luxury perfume | Undisclosed |

| January | Bombtostandout | Investment | Deconstruct | South Korean skincare | Undisclosed |

| February | Narotam Sekhsaria Family Office | Investment | Pilgrim | Indian beauty | 20 million USD |

| February | Silas Capital, etc. | Investment | DAMDAM | Japanese skincare | 3 million USD |

| February | Dodo Group, Luxury Brands LLC | Investment | Prai Beauty | American anti-aging brand | Undisclosed |

| February | Sandbridge Capital | Investment | Fara Homidi Beauty | American beauty | Undisclosed |

| February | Sandbridge Capital | Investment | Everist | Canadian beauty | Undisclosed |

| March | USHOPAL | Investment | PAYOT Paris | French skincare | Undisclosed |

| March | Domestic enterprise | Investment | Xu Na Beauty | South Korea | Undisclosed |

| March | Investment | Jinyanmei Biology | South Korea | Undisclosed | |

| March | Investment | Jinyanmei Biology | South Korea | Undisclosed | |

| March | Investment | SKKN by Kim | American skincare | Undisclosed | |

| March | ISEM Equity | Investment | Egsia | South Korean skincare | Undisclosed |

| March | Chengjin Capital | Investment | Indie | American beauty | Undisclosed |

| March | Chengjin Capital | Investment | Lucro Plastic | American plastic packaging | Undisclosed |

| March | Encore Consumer Capital | Investment | LYS Beauty | American skincare | Undisclosed |

| March | Vertinvest, etc. | Investment | Yepoda | South Korean skincare | Undisclosed |

| March | dsm-firmenrich Ventures, etc. | Investment | ExoLab Italia | Italian beauty | 5 million euros |

| March | Sycamore Partners | Investment | Walgreens Boots Alliance | American international beauty | About 10 billion USD |

| March | Domestic enterprise | Investment | Haihe | Chinese beauty | Undisclosed |

| March | Investment | Haihe | Chinese beauty | Undisclosed | |

| April | Redrice Ventures, Janjam, Saffle Investments | Investment | Skin Rocks | British beauty | Undisclosed |

| April | Sandbridge Capital | Investment | Deadcool | American niche perfume | Undisclosed |

| April | Investment | First Cover™ | South Korean beauty | Undisclosed | |

| April | Coco Chanel | Investment | Gerolymnis | Australian beauty | Tens of millions of Australian dollars |

| April | Investment | Gerolymnis | Australian beauty | 70 million USD | |

| April | Yuanzhi Venture Capital | Investment | Jinyumei Biology | South Korean skincare | 675 million USD |

| April | Oh My Cream | Investment | Atelier Nubio | French beauty | Undisclosed |

| April | The Hut Group | Investment | The Hut Group | British e-commerce beauty | 50 million USD |

| April | Insight Partners, etc. | Investment | Insight Partners | American beauty | 40 million USD |

| April | Global Investment Group AG | Investment | Revolution Beauty | British beauty | 60 million USD |

| May | True Beauty Ventures | Investment | Blank Beauty | American beauty technology | 6 million USD |

| May | Investment | Jupiter | American beauty | Undisclosed | |

| May | Shuimu Capital, etc. | Investment | Anonymous | South Korean skincare | 2.16 million USD |

| May | Shilei International Holdings, etc. | Investment | PMO Medical Aesthetics | Mass cosmetics company | 20 million USD |

| June | Movendo Capital, Draycott | Acquisition | Verescence | French glass packaging | Undisclosed |

| June | Unilever | Acquisition | Medik8 | British skincare brand | 300 million GBP |

| June | Yangshengtang Group | Acquisition | Dr.Squatch | American fragrance | Nearly 5 million USD |

| June | Investment | Messy | American beauty | 3.46 million USD | |

| June | Investment | Jinkang | South Korean beauty | Undisclosed | |

| July | Goodai Global | Investment | SINFOOD | South Korean food beauty | 15 million USD |

| July | Huda Kattan | Investment | Huda Beauty | American beauty | 1.6 billion USD |

| July | Elf Beauty | Investment | Rhode | American beauty | Undisclosed |

| July | Vollemens | Investment | Coler Wow | American hair care | Undisclosed |

| July | CLSA Capital Partners | Investment | Jungsaemmool Beauty | South Korean beauty | 5 million USD |

| July | TSG Consumer | Investment | Phlur | American fragrance | Undisclosed |

30 Billion Yuan Flows to 43 Brands

Due to the large number of investments and diverse categories in the first half of 2025, to better grasp the investment trends in the first half of 2025, we first focus on the investment trends in the brand field.

In this direction, the investment and financing market in the beauty brand field shows an appearance of “false prosperity”: the whole industry has completed 43 brand-oriented investment and financing events, a year-on-year increase of 70%.

| Inventory of Beauty Brand Investments in H1 2025 | ||||||

| Time | Type of Investor | Investor | Action | Invested/Acquired Party | Positioning | Amount |

| January | International beauty group | Unilever | Acquisition | Minimalist | Indian mass skincare | 2.493 billion yuan |

| January | Unilever | Investment | Ras Luxury Skincare | Indian luxury skincare | 35.87 million yuan | |

| January | Designworks Collective brand group | Investment | Archipelago Botanicals | American mid-range fragrance | Undisclosed | |

| January | Tru Fragrance & Beauty | Acquisition | Lake & Skye | American mid-range fragrance water | Undisclosed | |

| January | International good living fund | L Catterton under LVMH, etc. | Investment | California Naturals | American mass 洗护 | 28.7 million USD |

| January | KL & Partners | Investment | Mentholatum Manyo | South Korean mass skincare | 987 million yuan | |

| January | Domestic enterprise | Matrix Partners China | Investment | First Cover Youyi | Mass efficacious makeup | 100 million yuan level |

| January | Zhaoyue Pharmaceutical Cosmetics | Investment | Xingke | Brand incubation skincare | 37 million yuan | |

| January | Undisclosed | Investment | Xingke | Mass personal care | 1 million yuan | |

| January | International beauty group | L’Oreal | Investment | Jacquemus | French fashion brand | Undisclosed |

| January | L’Oreal | Investment | Amouage | Omani luxury perfume | Undisclosed | |

| January | L’Oreal | Investment | Bomtostandout | South Korean luxury perfume | Undisclosed | |

| January | BOLD, a fund under L’Oreal | Investment | Deconstruct | Indian mass skincare | 54 million yuan | |

| February | International good living fund | Narotam Sekhsaria Family Office, etc. | Investment | Pilgrim | Indian mass personal care | 166 million yuan |

| February | Silas Capital, etc. | Investment | DAMDAM | Japanese mid-range skincare | 21.52 million yuan | |

| February | Dodo Group, Luxury Brands LLC | Investment | Prai Beauty | British mass skincare | Undisclosed | |

| February | Sandbridge Capital | Investment | Fara Homidi Beauty | American high-end makeup artist makeup | Undisclosed | |

| February | Sandbridge Capital, etc. | Investment | Everist | Canadian high-end hair care | Undisclosed | |

| March | International others | Kim Kardashian | Acquisition | SKKN by Kim | American mid-to-high-end personal care and beauty | Undisclosed |

| March | International beauty group | Unilever | Investment | indē wild | Indian mass skincare | 35.87 million yuan |

| March | International good living fund | Encore Consumer Capital | Investment | LYS Beauty | American mass beauty | Undisclosed |

| March | Verlinvest, etc. | Investment | Yepoda | South Korean mid-range skincare | Undisclosed | |

| March | Domestic enterprise | Betteni | Investment | Yujian | High-end personal care brand | Undisclosed |

| March | International beauty group | Unilever | Acquisition | Wild | British high-end personal care | 193.7 million yuan |

| April | International good living fund | Redrice Ventures, Jamjar, Saffle investments | Investment | Skin Rocks | British mid-range skincare | Undisclosed |

| April | Sandbridge Capital | Investment | Dedcool | American niche fragrance | Undisclosed | |

| April | Domestic enterprise | Cathay Consumption Co-creation Fund | Investment | First Cover Youyi | Mass efficacious makeup | Undisclosed |

| April | International others | Oh My Cream | Investment | Atelier Nubio | French homemade small doses | Undisclosed |

| April | International good living fund | Insight Partners, etc. | Investment | Insight Partners | American mass makeup | 359 million yuan |

| May | International good living fund | True Beauty Ventures | Investment | Jupiter | American mass hair care | Undisclosed |

| May | Domestic enterprise | Shuiyang Co., Ltd., etc. | Investment | Zhu Bo | Mass clean beauty | Nearly 100 million yuan |

| June | International beauty group | L’Oreal | Acquisition | Medik8 | British efficacious skincare | 842.1 million yuan |

| June | International beauty group | Unilever | Investment | Dr.Squatch | American natural skincare | Undisclosed |

| June | Domestic well-known enterprise | Juyi Group | Investment | Baizhicui | Mid-range efficacious skincare | Undisclosed |

| June | International others | Haiziwang, Juzi Biology, etc. | Investment | Siyu Industrial | Mass 洗护 | 1.65 billion yuan |

| July | International beauty group | Goodai Global | Acquisition | SKINFOOD | South Korean mass skincare | 779 million yuan |

| July | International others | Huda Kattan | Acquisition | Huda Beauty | Middle Eastern mid-to-high-end celebrity beauty | Undisclosed |

| July | International beauty group | Elf Beauty | Acquisition | Rhode | American mid-to-high-end celebrity beauty | 7.2 billion yuan |

| July | Givaudan | Acquisition | Vollmens | Brazilian fragrance supplier | Undisclosed | |

| July | L’Oreal | Acquisition | Color Wow | American high-end hair care | Undisclosed | |

| July | International good living fund | CLSA Capital Partners | Investment | Jungsaemmool Beauty | South Korean high-end makeup artist makeup | 26 million yuan |

| July | TSG Consumer | Acquisition | Phlur. | American mid-range fragrance brand | Undisclosed | |

However, behind this seemingly prosperous data, there is a significant geographical differentiation – there are only 6 investment and financing events for domestic beauty brands, specifically including:

Matrix Partners China invested in First Cover Youyi, Challenger Venture Capital invested in Fuyumanpu, Zhoufen received investment, Betteni invested in Yujian, Shuiyang Co., Ltd. invested in Zhu Zhan, and Juyi Group acquired Baizhicui.

Youyi and Zhu Zhan are both makeup brands; the former is an efficacious base makeup brand founded by Wang Yuying, the former brand manager of Love Fire under Marubi, and the latter is a clean makeup brand that has long had a certain reputation; Fuyumanpu, Zhoufen, and Yujian are all personal care brands, and they all tend to body care.

Compared with 2024, domestic beauty brand investments are increasingly inclined to play safe: no longer chasing the popular perfume and efficacious skincare tracks, but comprehensively valuing the founder’s ability and brand growth potential.

Abroad, it is a different scene.

There are 37 investment events for foreign beauty brands, among which international beauty groups such as L’Oreal Group and Unilever participated in 14 beauty brand investment and financing events; international investment banks and funds such as LVMH’s fund participated in 19.

In terms of specific trend characteristics:

The perfume category maintains capital inflow. In the first half of 2025, the investment and financing activity in the perfume track continued to increase, with 8 transactions recorded, an increase of 167% compared with the same period in 2023 (3 cases) and 33% compared with the same period in 2024 (6 cases).

Among them, L’Oreal invested in two high-end perfume brands – Amouage and Borntostandout. The former is a “old money” in perfume with annual sales exceeding 2 billion yuan; the latter is a “new noble” in perfume, famous for its bold and unconventional characteristics.

In addition to L’Oreal, large international groups also prefer perfume. American consumer goods company Designworks Collective invested in the fragrance healing brand TSG Consumer, and North American consumer goods investment giant TSG Consumer invested in the American mid-range perfume brand Phlur…

The formation of this investment preference is positively correlated with the high growth of the American perfume market.

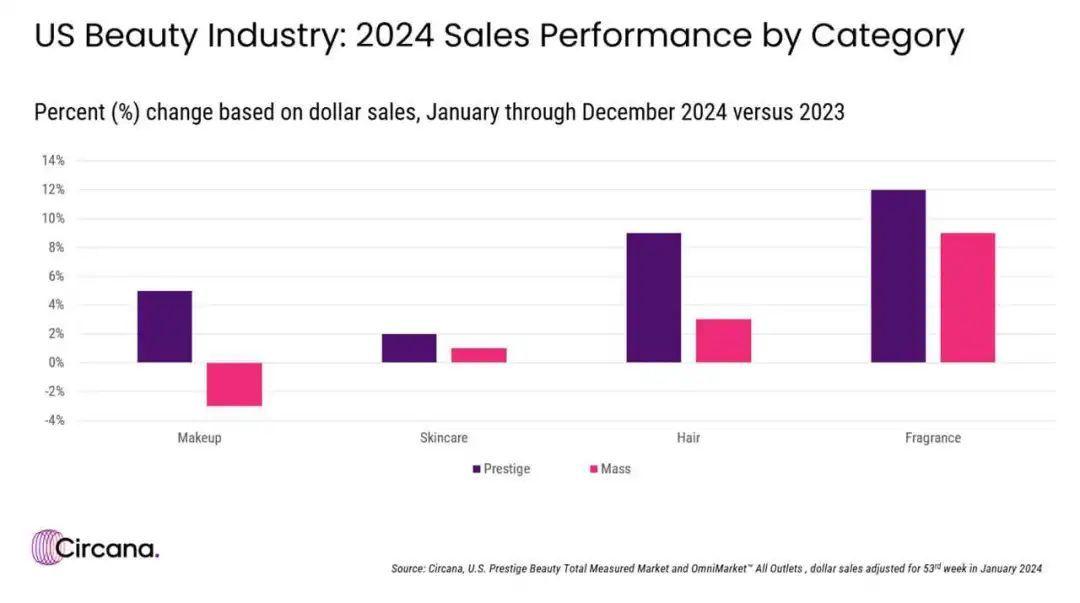

According to data from international market research agency Circana, perfume replaced skincare to take the second place and became the second largest category in the U.S. high-end beauty market in 2024, accounting for 28% of total sales in the high-end beauty market.

Circana’s year-end data on the 2024 cosmetics market: In the United States, the high-end beauty market is still the main driver of growth, with perfume and makeup being the two fastest-growing categories.

More specifically, in the high-end market, perfume sales increased by 12%, including 43% growth in essence and 14% growth in eau de toilette, both higher than the 5% growth rate of the makeup market and 2% growth rate of the skincare market.

Under the high growth trend, capital giants and consumer markets have formed a “two-way rush”.

Mass skincare/makeup becomes a new focus of capital allocation. Different from the investment trends a few years ago, mass skincare/makeup is replacing high-end skincare/makeup to become the new favorite of capital.

Among the 43 brand investments, there are 16 mass skincare/makeup cases (12 skincare, 4 makeup), accounting for 37%.

Among them, Indian mass skincare brands account for a relatively larger proportion. For example, Unilever acquired the Indian DTC beauty brand Minimalist with annual revenue exceeding 300 million yuan for 2.4 billion yuan, and invested in the skincare brand indē wild that focuses on the popular concept – Ayurveda; L’Oreal’s venture fund invested 54 million yuan in Deconstruct, and private equity KL & Partners invested in the South Korean mass skincare Witch Factory Manyo…

This trend further confirms that “international giants regard India as the next China”: after the new CEO of Unilever took office, he set the goal of “doubling India’s business”; L’Oreal recently appointed an Indian chairman and regional manager to accelerate its localization strategy in India.

Targeting the mass market is consistent with the global beauty market trend since 2024 that “mass products surpass high-end ones, and cheap ones defeat expensive ones”. Since the beginning of last year, mass beauty has become the main growth engine of companies such as L’Oreal and Unilever. Circana also indicated in its year-end data that top mass brands have performed strongly in market distribution.

The shift in capital trends this year has outlined this trend more clearly. Mass brands with relatively low prices, focus on brands, and highlight cost performance are reconstructing the value coordinate of global beauty investment with a stable consumer base.

25 Technology Investments: From Scale Expansion to Value Digging

Shifting the focus from the brand end to the depth of the industrial chain, we will find that technological elements are also reshaping the capital allocation logic of the beauty industry.

In the first half of 2025, raw material R&D and AI technology enterprises became one of the most active tracks with 25 financing events (accounting for 31.6%), which is 4 percentage points higher than 2024 and 39% higher than the same period in 2023.

However, behind the seemingly stable growth curve, three changes are emerging:

Surge in Synthetic Biology Financing Scale, Decline of Recombinant Collagen

In 2024, synthetic biology was a golden track for beauty capital allocation. In the upstream field alone, 10 financing cases of synthetic biology enterprises emerged in the first half of that year. However, the largest amount was only nearly 100 million yuan.

| Inventory of Invested Synthetic Biology Enterprises from January to July 2024 | ||||

| Time | Invested Party | Establishment Time | Amount | Investment Institution |

| January | Weidakang | 2021 | Nearly 100 million yuan | Led by Yida Capital, followed by Huachuang Yida |

| March | Tushen Zhihe | 2023 | Millions of yuan | Chengmei Capital |

| April | Baikuirui | 2019 | Tens of millions of yuan | Led by Qinzhi Capital, followed by Yueke Finance |

| April | Xiangya Biology | 2020 | / | Mylike Medical |

| April | Fulaiming Biology | 2017 | Tens of millions of yuan | Guangdong Medical Insurance Pharmaceutical, and several pharmaceutical company |

| May | Junhemeng | 2020 | 100 million yuan | Tonghua Dongbao |

| May | Nanjing Yiweisen | 2018 | Millions of yuan | Invested by Huang Hao, chairman of Yuantong Fund |

| June | Weiyuan Biology | 2023 | Tens of millions of yuan | Undisclosed |

| July | Nuohexin Biology | 2022 | Tens of millions of yuan | Led by Shanghai Jiusong Shanhe, followed by Zhangjiagang Jinxin Capital and Zhangjiagang Fund Pai Venture Capital |

| July | Meishangjie Biology | 2018 | / | Venture Capital (Huzhou) Partnership, the main body of Huixi Industrial Investment, and Shanghai Shuiyang Management Consulting Co., Ltd. |

This year, although there were only 4 financing events in the synthetic biology field, the scale of a single investment increased significantly – one of them reached 150 million yuan, two were close to 100 million yuan, and the lowest single investment was tens of millions of yuan. The average single financing amount in the industry increased by about 260% compared with the same period in 2024.

| Inventory of Invested Synthetic Biology Enterprises from January to July 2025 | ||||

| Time | Invested Party | Establishment Time | Amount | Investment Institution |

| January | Yinuojike | 2021 | Nearly 100 million yuan | Led by Yida Capital, followed by Huachuang Yida |

| March | Jinsan Biology | 2023 | Millions of yuan | Chengmei Capital |

| May | Weiming Shiguang | 2021 | 100 million yuan | Tonghua Dongbao |

| May | Junhemeng | 2020 | Millions of yuan | Invested by Huang Hao, chairman of Yuantong Fund |

This investment characteristic of “reduced quantity but increased quality” reflects that capital has shifted from extensive layout to key investment in technically mature enterprises.

The sharp decrease in quantity is mainly due to the significant contraction of financing in the recombinant collagen track.

Among the 10 investment and financing events last year, 4 were directly related to recombinant collagen, but this year, no enterprise with recombinant collagen as the core technology has received a new round of financing.

This evolution essentially means that the synthetic biology track is moving from “wild growth” to “intensive cultivation”.

As leading enterprises such as L’Oreal, Shiseido, and Jinbo Biology have successively completed the capacity positioning of recombinant collagen, the track is gradually facing challenges such as declining technical dividends and serious homogenization, which will directly lead to the contraction of space for capital to provide technology replication projects.

This shows that even with the technology card, it is not easy to cheat capital’s money.

Supply Chain Enterprises Step into the Spotlight

In addition to synthetic biology, the supply chain is gradually emerging as a key variable in industrial competition.

International enterprises have taken the lead in layout: Unilever invested in Indian flexible packaging recycling enterprise Lucro Plastecycl; international funds Movendo Capital and Draycott acquired the French beauty product glass packaging factory Verescence; the domestic market is also undercurrent, such as Zhongke Chuangxing investing in Jingcui Biology, Guangzhou Xingyuan Plastic, a supplier of biosurfactants.

This series of strategic layouts reveals a new industry trend: the supply chain, a traditionally auxiliary link, has increasingly risen to become one of the core competitiveness of the beauty industry. Capital is comprehensively enhancing enterprise value by further integrating the supply chain system.

“East-West Division” between AI and Regenerative Medicine

Last year, artificial intelligence and regenerative medicine had attracted capital attention. In the first half of this year, these two sub-tracks showed obvious differentiation:

In the international market, international capital continues to increase investment in digital solutions, such as L’Oreal Group investing in AI advertising technology platforms and Evolution VC Partners injecting capital into AI makeup R&D enterprises.

In contrast, in the domestic market, capital prefers bio-material enterprises where local enterprises have more advantages. Cases such as Marubi Biology’s strategic investment in Zhisheng Runhe and Kangzhe Pharmaceutical’s stake in Baiyiyuan Biology highlight capital’s deep cultivation in regenerative medicine.

This different layout reflects the investment logic of “maximizing local advantages”. On the one hand, in terms of technical reserves, international giants have more accumulation in the AI field, while domestic enterprises have more advantages in bio-materials; on the other hand, in terms of market demands, European and American consumers are more accepting of digital solutions, while the Asia-Pacific market prefers bio-active ingredients.

This innovation competition triggered by differences in capital allocation may further widen the evolution of technical investment preferences at home and abroad.

New Hunting Rules: From Opportunity Hunting to Deterministic Cultivation

Under the resonance of multiple changes, the logic of capital allocation is undergoing a major change.

Marina Catino, a partner at global high-value management consulting firm Kearney, said that since 2024, the dynamics of the capital market have reflected a structural transformation – large capital transactions have decreased, turning to flexible and highly attractive brands; in addition, the strategic logic of capital buyers is changing – taking portfolio diversification as the strategic fulcrum and re-engineering the growth engine as the goal.

In this case, acquiring new consumers will become the main reason for strategic buyers to conduct merger and acquisition transactions in 2025: entering new markets, reaching a new generation of consumers, and opening up new channels.

The investment and financing cases in the first half of this year further confirm this. We can see:

Rise of Long-Termism, Upgrade of Capital’s Underlying Logic

Taking China as an example, there have been two investment and financing booms in China:

One was from 2014 to 2016. Against the background of the rapid growth of domestic e-commerce and mobile e-commerce, investment and financing events such as e-commerce operation and O2O e-commerce frequently occurred.

The other was from 2019 to 2021. Private equity financing and IPO listings of Chinese cosmetics enterprises jointly created a second small upsurge. During this period, Proya, Betteni, etc. were listed on the A-share market successively; Yixian E-commerce’s IPO in the US stock market created a capital myth; coupled with the rise of live streaming and the popularity of beauty collection stores, VC/PE enthusiasm was unprecedentedly high.

In these two boom periods, popularity meant valuation, and traffic was the truth.

However, since the second half of 2021, investment and financing have entered a cold winter. Until 2023, the industry lamented that “capital no longer invests in beauty”. In the past two years, capital has gradually recovered, but behind the recovery, there is a more prudent attitude:

Investors and analysts are focusing on brands that pay attention to performance and have long-term potential, no longer hurriedly calling for the next L’Oreal.

Marissa Lepor, partner and head of beauty business at investment bank The Sage Group, LLC (US), said: “These brands have performed well in market distribution and have clear core strategies and profit paths.”

Four Tracks with the Greatest Certainty

Under the guidance of this long-term values, many global beauty analysts predict that four sub-tracks, namely 1. biotechnology; 2. clinical skincare; 3. sustainable beauty; 4. regional local popular brands, will receive more capital attention.

For the first two, analysts said that on the basis of consumers’ preference for brands with scientific basis and practical solutions, they will pay more and more attention to brands dedicated to microbiome science and longevity research.

For sustainable beauty, it is believed that it is no longer just a trend, but will be an expectation. “Consumers will increasingly want products that are both environmentally friendly and do not sacrifice efficacy”. Under such demand, brands featuring green chemistry, upgraded and recycled ingredients, and refillable packaging are particularly attractive to potential buyers.

As for regional local popular brands, it is more due to beauty enterprises’ search for new regional growth points. After a long period of imitating and pursuing European and American high-end brands and lifestyles, consumers in countries such as South Korea and India will take the initiative to return to local culture, and their interest in local niche brands will increase.

In the view of Ilya Seglin, managing director of American investment bank Cascadia Capital:

“Brands with capital demand transactions in the next 12-18 months should use this time to prepare. Build differentiated capabilities and become pioneers in the track; otherwise, following will only face liquidity discounts.”