With the continuous growth of global skincare consumption, the skincare product packaging market is entering an era of unprecedented development opportunities. As an indispensable part of the industry chain, packaging is not only the “outer layer” of a product but also an important medium for conveying brand values and connecting with consumers. In 2025, this market is expected to undergo a transformation driven by technological innovation, environmental trends, and upgraded consumer demands, resulting in a new landscape characterized by market expansion, structural optimization, and enhanced value.

- Market Expansion: Consumption Upgrade Drives Industry Growth

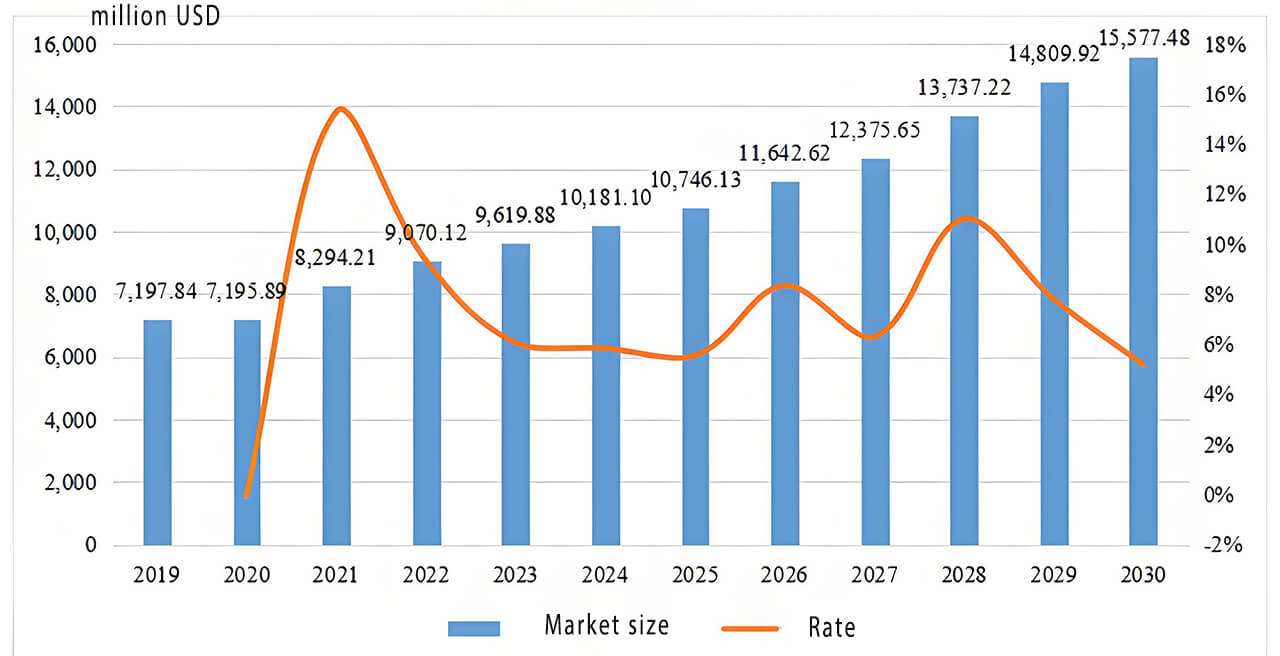

As the world’s second-largest cosmetics market, China’s explosive demand for skincare products has directly fueled growth in the packaging industry. According to data, by 2025, the Chinese skincare product packaging market is expected to exceed 31.29 billion RMB, while the global cosmetics packaging market will continue to expand at an annual growth rate of over 5%. Behind this trend is the increasing demand from consumers for skincare products that offer better functionality, safety, and overall experience.

On the demand side, the consumer base for skincare products is becoming increasingly younger and more segmented. Generation Z consumers are more inclined to pay for personalized, aesthetically pleasing products, while the rise of niche categories like anti-aging and sensitive skin care has also driven the demand for differentiated packaging. Meanwhile, the size of the Chinese skincare market is expected to reach 391.72 billion RMB by 2025, continuously injecting growth momentum into the packaging industry.

- Material Innovation: A Dual Revolution of Sustainability and Functionality

Currently, plastic remains the dominant material for skincare product packaging, accounting for 71.25% of the market share in 2022. However, its advantages in lightweight and cost-effectiveness are being challenged by environmental policies. Driven by the European Union’s “Plastic Ban” and China’s “Dual Carbon” goals, the development of biodegradable materials, recycled plastics, and paper-based packaging is accelerating. For example, brands like L’Oréal and Shiseido have launched bio-based packaging made from sugarcane pulp, while recyclable aluminum cans and glass bottles occupy a niche in the premium market (around 9.44% market share).

Technological breakthroughs are also enhancing the added value of packaging:

- Smart Packaging: Embedding RFID chips or QR codes to enable product traceability, usage reminders, and enhanced user interaction.

- Active Packaging: Adding antimicrobial coatings or humidity-regulating materials to extend product shelf life.

- Lightweight Design: Reducing material usage while maintaining protective qualities to lower the carbon footprint.

In the future, innovations like nanomaterials and 3D printing technology could further disrupt traditional packaging forms, such as customized bottle structures and dissolvable packaging films, driving the industry toward a “tech + sustainability” dual transformation.

- Design Trends: Comprehensive Upgrades from Aesthetics to User Experience

In the “aesthetic economy” era, packaging design has become a core battleground for brand competition. The design trends for 2025 will focus on the following directions:

- Minimalism and Natural Aesthetics: Using pure color schemes (e.g., Morandi colors) and natural textures (e.g., wood grain, stone textures) to convey a “pure skincare” concept, resonating with young consumers’ pursuit of simplicity and healthy living.

- Personalized Customization: Offering limited edition packaging, engraving services, or modular designs (e.g., replaceable refill cores) to meet consumers’ desires for uniqueness and participation.

- Functional Optimization: Examples include vacuum pump bottles that reduce oxidation and light-blocking designs that protect active ingredients, improving the user experience.

It is also crucial for packaging design to align deeply with brand positioning. Premium brands tend to use glass, metal, and other materials to emphasize luxury, while affordable brands attract the mass market through creative shapes and IP collaborations.

- Green Transformation: Policy and Consumer Demand Drive Industry Upgrades

Environmental sustainability has become a global consensus in the packaging industry. China’s “14th Five-Year Plan for Circular Economy Development” clearly calls for promoting green packaging, and consumer research shows that over 60% of Generation Z is willing to pay a premium for eco-friendly packaging. In this context, businesses need to address three key areas:

- Material Substitution: Accelerating the development of low-carbon materials such as bio-based plastics and bamboo fibers.

- Circular Systems: Collaborating with recycling companies to establish closed-loop systems, such as L’Oréal’s “Empty Bottle Recycling Program.”

- Green Certification: Enhancing brand credibility through FSC forest certification and carbon-neutral labels.

However, the transition to sustainable packaging also faces challenges like high costs and technical barriers. Small and medium-sized enterprises can balance costs and benefits by adopting lightweight designs or using eco-friendly materials in select areas.

- Competitive Landscape: Polarization and Global Competition

The skincare packaging industry is currently characterized by a “stronger players dominate, smaller players specialize” competitive pattern:

- Leading companies (e.g., Albéa, HCP) dominate the market through large-scale production, technological innovation, and global expansion.

- SMEs gain ground by focusing on niche markets, such as specialized packaging or customized services.

As China’s cosmetics export scale expands (with exports growing 21% year-on-year in 2023), domestic packaging companies need to enhance their international capabilities. For example, East China, with its complete industrial chain (home to 47.3% of the nation’s packaging companies), has established a full-chain advantage from mold design to production. In the future, these companies may expand into international markets through initiatives like the “Belt and Road” initiative.

- Future Outlook: Resonance of Technology, Policy, and Consumer Trends

After 2025, the skincare packaging market is expected to exhibit three major trends:

- Increased Smart Packaging Penetration: IoT technology will turn packaging into a data connection point between brands and consumers.

- Scalability of the Circular Economy: Policy subsidies and consumer education will promote the widespread adoption of recyclable packaging systems.

- Emerging Markets on the Rise: Southeast Asia, the Middle East, and other regions will become new growth drivers for Chinese packaging enterprises.

Conclusion

The explosion of the skincare product packaging market is a result of the intersection of consumption upgrades, technological revolutions, and sustainable development principles. For companies, the key to success lies in responding to environmental demands through innovation, empowering brand value through design, and expanding markets with a global perspective. In the future, packaging will no longer be just a container, but a comprehensive vessel that integrates technology, aesthetics, and responsibility, becoming a key force in driving the industry’s high-quality development.